Sell to a Tech‑Enabled Operator Who Will Grow Your Legacy

We acquire B2B technology-enabled service companies with $2M to $5M in EBITDA, 3× to 4× multiples, strong recurring or contracted revenue, and bolt-on acquisition potential. SBA-eligible businesses with 20%+ EBITDA margins, low customer concentration, and motivated sellers (retirement, lifestyle change, relocation) are preferred.

Our focus areas include..

IT Services & MSPs (cloud, data engineering, cybersecurity)

Cloud & Data Consultancies (Snowflake, AWS, GCP)

Analytics-as-a-Service & BI platforms

Workflow Automation, API, and Integration SaaS

We offer flexible deal structures including seller financing and earnouts to reduce seller risk and close quickly. Our goal: a smooth transition that maximizes legacy and value.

Let’s Talk About Your Business → Free Confidential Valuation

Confidential Valuation

Get a free, no-pressure business valuation and walk away with real insights—even if you never sell.

Founder-Centric Process

We buy businesses with empathy and transparency. You’ll always know where you stand—and what comes next.

Tech-Enabled Growth

Post-acquisition, we apply AI, automation, and operational best practices to scale your legacy.

About Our Company

Technology-Driven M&A for Modern Business Owners

At Celcor AI Solutions, we acquire and grow businesses that are built on strong fundamentals. Our specialty is buying $1M–$5M EBITDA companies—especially in SaaS and home services—and increasing their value using AI, automation, and streamlined operations. We understand your business is personal. That’s why we lead with professionalism, discretion, and a shared respect for what you’ve built.

Our Service

Acquisitions. Optimization. Long-Term Value.

Whether you're ready to sell, considering strategic equity partnerships, or just exploring your options—we’re here to make the process simple, fair, and founder-focused. Our services are built around your unique needs and timeline.

Exit Readiness Audit

Understand your true value with our in-depth business audit covering financials, operations, and growth levers.

Confidential Acquisition

Structured deals like LBOs or Consulting-for-Equity (CFE) that ensure your team and legacy are preserved.

Operational Optimization

We don’t just buy—we scale. Using automation, AI, and analytics, we unlock hidden margin and performance.

Roll-Up Strategy

Planning your next move? We help owners exit or bolt-on businesses into broader strategic plays.

Equity Partnerships

Not ready to sell? We offer CFE structures to bring automation and data-driven growth to your business today.

AI & Automation Roadmapping

We engineer bespoke roadmaps to improve EBITDA through intelligent systems and automation.

Why Choose Us

Exit on Your Terms—Backed by Real Operators

We don’t operate like traditional private equity. As seasoned engineers and growth advisors, we know how to unlock business potential post-acquisition. We honor your vision, take care of your team, and help your legacy thrive.

Strategic, Not Generic

Each deal is tailored. Whether LBO or equity-partnership, your outcome drives our structure.

Data-Driven Growth

We’re not just investors—we’re data engineers and automation experts. We use modern tools to unlock hidden margin, improve efficiency, and drive valuation long after you exit.

Real-World Experience

We’ve built and automated systems inside billion-dollar enterprises—and we bring that to your business.

Post-Sale Support

We provide continuity and care—so you’re free to enjoy what’s next without worry.

Easy Three Step Process

How it works

First Step

Second Step

Third Step

Consultation

A confidential conversation to understand your goals and assess fit—no commitments, no pressure.

Discovery

We review your operations and financials and present a fair offer or optimization partnership.

Transition or Growth

We close quickly and begin enhancing your business using automation, AI, and data systems.

Selling a Business Doesn’t Have to Be Complicated

We provide a modern, tech-savvy approach to acquisitions, built around your timeline and needs. Whether you’re ready now—or just exploring—schedule a confidential call to explore your options.

Explore Our Exit Planning Options

Structured to Fit Your Goals—Not Ours

Whether you want to exit fully, retain equity, or scale your business with our help—we structure flexible deal options that support your next chapter.

Full Exit

Full Buy Out

$ 0

Monthly

Walk away with peace of mind.

Structured buyout with smooth team transition.

Equity Partnership

10% equity swap

Custom

Monthly/Quarterly

Keep ownership

We modernize your business with AI and automation

Bolt-On Strategy

Custom terms

$ 0

Monthly

We acquire complementary businesses

Integrate them under your brand, or ours

Testimonial

Our Clients Reviews

Celcor made the process easy and transparent. I always knew where we were in the deal.

SaaS Founder, Atlanta

Their team brought operational firepower post-acquisition. Automation has doubled our margins.

Home Services Owner, Southeast Atlanta

FAQ

Frequently Ask Questions.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

What types of businesses do you buy?

We acquire businesses doing $1M–$5M in EBITDA, preferably SaaS or home services, with healthy margins and growth potential.

Do you require owners to stay on?

It depends on your goals. We offer both full exits and transitional roles.

How fast can you close?

Typically within 45–90 days, depending on financial readiness and deal structure.

Get In Touch

Email: [email protected]

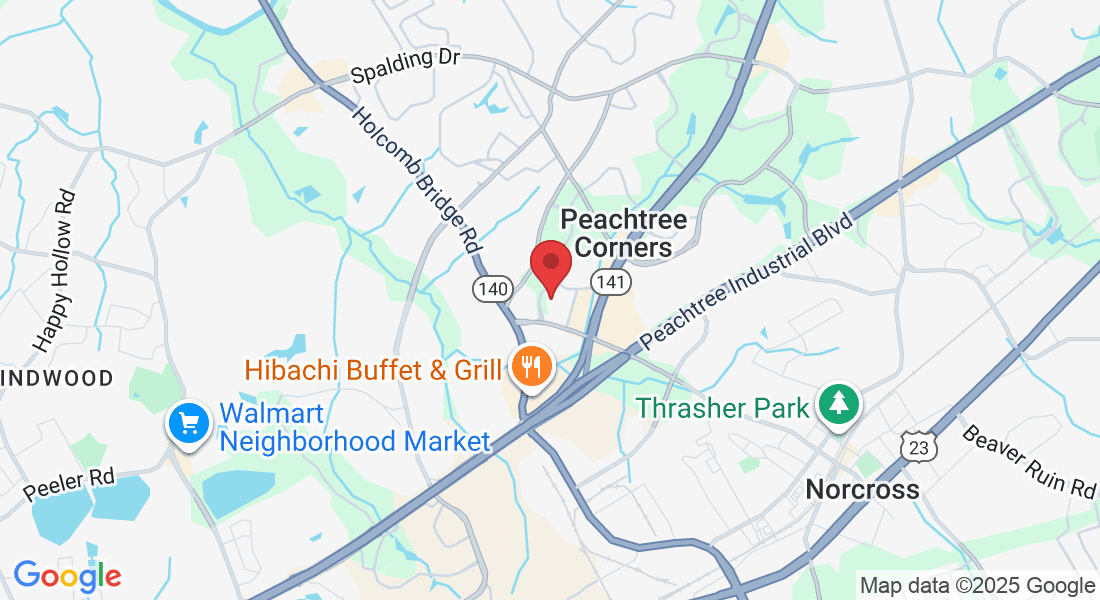

Address

Office: 6075 The Corners Pkwy, #210

Peachtree Corners, GA 30092

Assistance Hours

Mon – Fri 9:00am – 5:00pm

Sat 10am - 4pm

Sunday – CLOSED

Phone Number:

(770) 800-8893

2025 Celcor AI Solutions . All rights reserved